Optimise strike dates

for maximum success

Use data-driven insights to choose the best debit order dates, reduce failed collections, and improve cash flow reliability.

What is Strike Date Optimisation

Strike Date Optimisation selects the best date to debit a customer’s account based on payment patterns and salary cycles. It helps reduce failed collections, improve success rates, and ensure more reliable cash flow.

Secure

Reduce payment failures by aligning debit dates with customer salary patterns—improving trust and financial stability.

Automated

Use intelligent algorithms to automatically select the optimal debit date for each customer—no manual intervention needed.

Real-time

Access real-time data to dynamically adjust debit schedules and respond quickly to changes in customer payment behavior.

Insights

Gain insights into collection patterns and success rates to refine your strategy and boost overall payment performance.

Save Costs

Reduce failed debits, penalty fees, and manual reprocessing costs by striking at the right time—every time.

Integrate

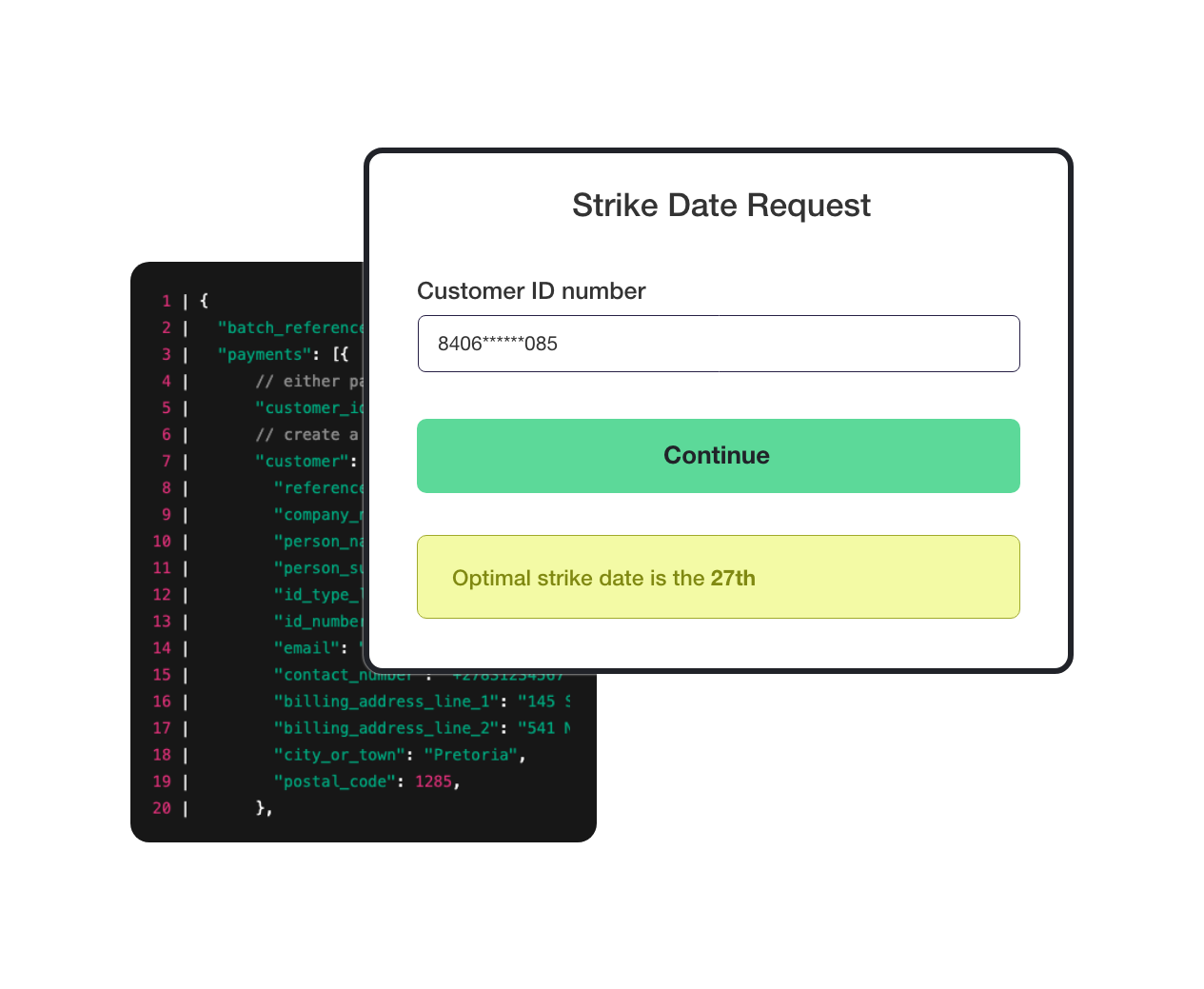

Easily plug into your existing systems with our API to activate strike date optimisation at scale—fast and hassle-free.

Let`s do business

Why Kwik Payments?

Lower Costs at Scale

Industry-leading rates designed for high-volume transactions.

Reliable Automation

Streamline recurring payments, reconciliations, and payouts with minimal manual effort.

Enterprise-Ready Integration

Seamlessly connect to your ERP, CRM, or billing system via robust APIs.

Compliance & Security

PASA-approved with bank-level security and full regulatory compliance.

Elevate your payments today!

Streamline payments, reduce costs, and offer more ways to pay — all from one powerful platform.